Reveal Marketing Research Study: Romania’s Private Sector in 2025: Strained, Reactive, and Directionless

Reveal Market Resources, Study no. 199

Companies in Romania are operating in emergency mode: over 1 in 3 report a severe economic impact. Investments are postponed, and decisions suspended.

Reveal Marketing Research conducted an internal study in July 2025 among employees from the private sector — decision-makers and specialists from companies of all sizes and industries — to understand how they perceive the current economic environment and how they adapt to the major challenges facing Romania in 2025: fiscal instability, depreciation of the leu, declining consumption, and unpredictability in public policies.

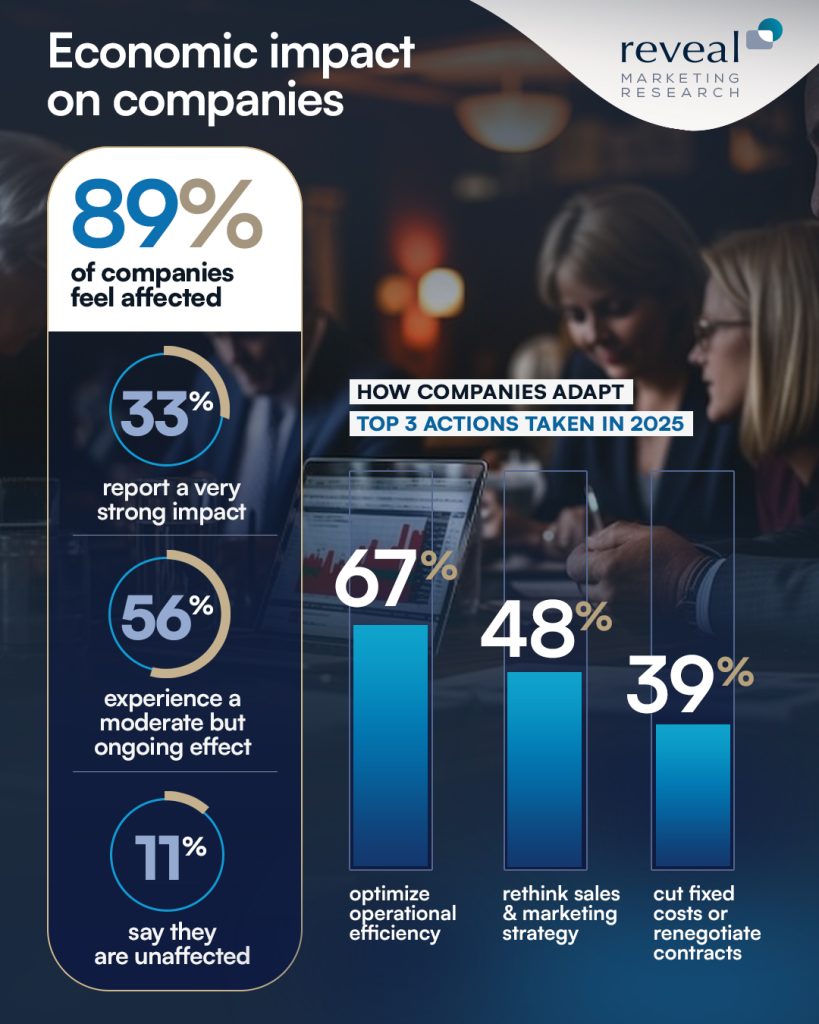

89% of companies are affected. For 1 in 3, the impact is “very strong.”

89% of companies report a negative impact: 33% describe the situation as “very strong,” while 56% speak of a moderate but persistent impact affecting their plans and draining internal resources. Only 11% say they are relatively unaffected — mostly smaller firms or managers not directly handling financial pressure.

Facing an unpredictable economic context, companies in the private sector are reacting promptly — but tactically rather than strategically. Most frequent responses indicate a fast shift towards efficiency, not growth: cost optimization, adjusting sales strategies, and contract renegotiation are the top immediate priorities.

Most common measures reported:

- 67% focused more on operational efficiency

- 48% redesigned their sales and marketing strategies

- 39% reduced fixed costs or renegotiated contracts

- 18% shifted toward lower-cost products and services

- 16% suspended growth plans

- Only 12% say they maintained their original direction

The alarm signal is clear: only 1 in 10 companies says nothing has changed. The rest are already adjusting — but without a long-term vision. Brands feel enormous pressure to stay relevant “here and now,” not necessarily sustainable over time.

Investments are the first to go: surviving, not building In today’s uncertain environment, private companies are conserving resources and avoiding any move that doesn’t guarantee immediate returns.

- 30% postponed investments in equipment or infrastructure

- 18% suspended expansion plans into new markets

- 14% put IT or digitalization projects on hold

Perhaps the gravest signal comes from human resources: 52% of companies have postponed hiring or team expansion — a number suggesting not just caution, but a severe halt in development. “We no longer invest in anything that doesn’t bring immediate return.” — Operational Manager, FMCG sector

This reactive approach confirms the general tendency to “live month by month,” with no appetite for risk or long-term strategy.

What (still) works in 2025: survival through adaptation, not vision

In an economy dominated by uncertainty, companies are choosing efficiency over innovation, adaptation over expansion, and empathetic communication over bold promises. Responses clearly reflect a survival instinct: deliver what is needed, speak transparently, and keep the team motivated.

- 66% rely on adapting offers quickly to market demand

- 45% emphasize transparent communication with clients and partners. In an unstable climate, honesty becomes a competitive advantage.

- 44% invest in team motivation and training. Even though hiring is frozen in 52% of companies, those who remain must be supported. In the absence of external resources, human capital becomes the main engine of adaptation.

Direction is lacking. Clarity is needed, not capital.

Despite the difficult climate, only 16% of companies explicitly mention the need for financial solutions (credit, leasing, factoring). Not because they don’t need help, but because the priority has shifted from survival to navigating wisely. Instead:

- 59% rely on networking and strategic partnerships, indicating that exiting the crisis can no longer be individual — but must be collaborative.

- 45% request market data and sector studies, hoping to make correct, reality-based decisions rather than relying on instinct.

“The results of this study are a wake-up call that can no longer be ignored: Romania’s private sector is operating in emergency mode, not development. The numbers are clear — 89% of companies are affected, and over half are postponing essential investments, including in digitalization, expansion, and their teams. We’re living in a time when the survival instinct has replaced strategic planning, and priorities have shifted from building to enduring. As leaders in the economy, we have the responsibility to look beyond quick fixes and cultivate a mindset of clarity, collaboration, and long-term thinking. It’s clear the solution is no longer extra capital, but access to relevant data, smart partnerships, and the ability to turn uncertainty into a driver of conscious adaptation. If we want to break out of this systemic deadlock, we must move the conversation from ‘how do we endure today’ to ‘where do we want to be tomorrow.’” — Marius Luican, CEO, Reveal Marketing Research

Priorities differ significantly by role and company size:

- CEOs want action: only 21% of general managers mention the need for market data, but nearly half (47%) demand rapid and firm decisions.

- Middle management wants guidance: 62% of department managers ask for external insights to better understand the context.

- Small companies seek connections: 84% of firms with under 50 employees say networking and strategic partnerships are their most important resource.

- Large companies seek control: 55% of large businesses request market data, and 33% want tech support for efficiency and visibility.

This fragmentation shows there’s no one-size-fits-all solution — but the shared need is for strategic orientation, not just operational reaction.

What’s next?

The study confirms what is already felt informally: the private sector is on high alert but lacks a clear exit strategy. Without strategic interventions and stabilizing measures — fiscal, administrative, and commercial — we risk a silent crisis, where each company manages its own blockage without collective support or coordination.

About Reveal Marketing Research

Reveal Marketing Research is a full-service market research company specialized in marketing studies, sociological analysis, customer insights, business strategy, and market development. With expertise across more than 20 industries, Reveal believes that market research is the foundation of sound decision-making and brand positioning. For the past 17 years, its qualitative and quantitative solutions have supported companies in Romania and across Europe.

Reveal Market Resources, Study no. 199:

Reveal Market Resources is a data hub that includes freely published studies, aimed at supporting Romania’s marketing and communication sector.

Methodology:

Reveal Marketing Research conducted an internal study with a sample of 402 private sector employees — including white, gold, and blue-collar workers — from companies of all sizes and industries. Most respondents are involved in decision-making or influence internal strategies (marketing, sales, communication, HR, management).